2022-0926441C6 IFA 2022-Q 14–Partnership and Subsection 90(3)Election

Please note that the following document, although believed to be correct at the time of issue, may not represent the current position of the CRA. Prenez note que ce document, bien qu'exact au moment émis, peut ne pas représenter la position actuelle de l'ARC.

Principal Issues: Who should make a subsection 90(3) election when a dividend is paid to a partnership.

Position: A subsection 90(3) election will be valid if made by a member of the partnership who has authority to act for the partnership provided the election is made in accordance with subsection 96(3) and within the timeframe specified in subparagraph 5911(6)(a)(i) of the Regulations.

Reasons: On the facts of this Question 14 and on the assumption that the partnership is the relevant taxpayer in subsection 90(3), there is no connected person or partnership in respect of the taxpayer as defined in subsection 90(4).

Author:

Eroff, Ina

Section:

90(3), 90(4), 96(3), Reg.5911(6)

2022 International Fiscal Association Conference

CRA Roundtable

Question 14 – Partnership and Subsection 90(3) Election

A distribution made by a foreign affiliate of a taxpayer in respect of a share of its capital stock will be a qualifying return of capital pursuant to subsection 90(3) of the Act where the following conditions are met: (i) the distribution is a reduction of the paid-up capital of the foreign affiliate in respect of the share, (ii) the distribution would otherwise be deemed under subsection 90(2) to be a dividend paid or received on the share, and (iii) an election is made in respect of the distribution in accordance with prescribed rules.

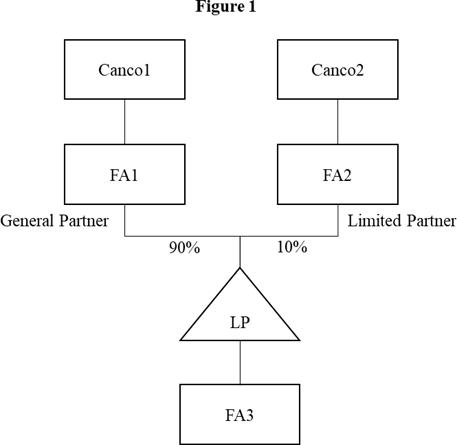

Assume the following facts (see figure 1):

1) A Canadian corporation (Canco1) owns 100% of a foreign affiliate (FA1);

2) A related Canadian corporation (Canco2) owns 100% of a foreign affiliate (FA2);

3) LP is a partnership for purposes of the Act;

4) FA1 is the general partner of LP, is the only member that has authority to act for LP and has a 90% partnership interest in LP;

5) FA2 is a limited partner of LP and has a 10% partnership interest in LP;

6) LP owns 100% of a foreign affiliate (FA3);

7) Canco1 and FA1 each has a taxation year ending November 30; each of Canco2, FA2 and FA3 has a taxation year ending December 31; LP has a fiscal period ending December 31; and

8) On July 1, 2021 FA3 reduced its paid-up capital and made a distribution to LP (the “Distribution”).

FA3 is a foreign affiliate of LP, and for purposes of (inter alia) section 90 is a foreign affiliate of both Canco1 and Canco2 pursuant to subsection 93.1(1).

Our questions are:

(i) Would the CRA agree that only LP is required to make a subsection 90(3) election in respect of the Distribution?

(ii) If a joint election is required to be made, or is made, by LP, Canco1 and Canco2, can LP file the election on behalf of itself, Canco1 and Canco2?

(iii) Would the election, if a joint election, be required to be filed by the earliest of the filing-due dates for Canco1 and Canco2 for their taxation years that include December 31, 2021?

CRA Responses

Question 14 (i):

Based on the facts of this question, the conditions in subparagraphs 96(3)(a)(i) and (ii) are met and a subsection 90(3) election in respect of the Distribution will be valid if made only by FA1 in its capacity of the general partner on behalf of LP because there is no “connected person or partnership” in respect of LP within the meaning of subsection 90(4).

Such election has to be made in the manner and within the timeframe specified in subparagraph 5911(6)(a)(i) of the Regulations. The election has to be made by FA1 by notifying the Minister in writing on or before the filing-due date of FA2 for its taxation year ended on December 31, 2021.

As there is no prescribed form for a subsection 90(3) election, the election is to be made in a form of a letter signed by FA1 in its capacity as the general partner of LP and filed with the Minister of National Revenue by the earliest of the filing-due dates set out in subsection 5911(6) of the Regulations.

The letter needs to contain information sufficient to allow the CRA to determine that the election is made in compliance with paragraph 96(3)(a) and the election must be made within the applicable time period prescribed in subsection 5911(6) of the Regulations. The general partner shall use its best efforts to identify in the letter all Canadian resident taxpayers of which FA3 (the entity making the distribution) is a foreign affiliate for the purposes of subsection 90(3).

Where the partnership making the election is not subject to Canadian filing requirements, the election letter is to be sent to the tax center of record of one of the Cancos. Since Canco2 has the same filing-due date as FA2, attaching this election to Canco2’s income tax return for its December 31, 2021 taxation year would be the recommended manner of notifying the Minister of the election on the facts at issue (assuming the income tax return is filed with the Minister by its filing-due date).

The following information needs to be included in the letter when subsection 90(3) election is made by a partnership:

? name, address and taxpayer identification number (if any) of the foreign affiliate making the distribution;

? partnership’s name, address, account number (if any) and fiscal period end;

? names, addresses and business numbers of each Canadian resident taxpayer of which the foreign affiliate making the distribution is a foreign affiliate;

? amount of the distribution made;

? the date(s) the distribution was made.

The information required by the CRA to be included on the election letter as listed above is dictated by the text of subsection 90(3) as informed by its context and purpose.

From an administrative perspective, the following practices are recommended in the interest of ensuring that the information described on a duly completed subsection 90(3) election letter is processed appropriately without delays or complications:

- A copy of the election is to be provided to each Canadian resident taxpayer identified on the election letter.

- In addition to being filed by the partnership as indicated above by the relevant filing-due date, the Canadian resident taxpayer may choose to attach a copy of the election to the taxpayer’s earliest T1134 Information Return Relating To Controlled and Non-Controlled Foreign Affiliates or income tax return for the taxation year that includes the relevant fiscal period end of the partnership.

Question 14(ii):

If a joint election is made by LP, Canco1 and Canco2, CRA would accept it as valid and would accept the required election made by FA1 on behalf of LP, Canco1 and Canco2 provided such election letter includes all the required information as outlined in response to Question 14(i).

Question 14(iii):

If an election is made jointly by Canco1, Canco2 and LP in respect of the Distribution, it is required to be made on or before the earliest of the filing-due dates of Canco1, Canco2, FA1 and FA2 for their respective taxation years that include December 31, 2021, in accordance with paragraph 5911(6)(b) of the Regulations.

Ina Eroff

2022-092644

May 17, 2022

Response prepared in collaboration with:

Terry Young

Administrative Law Section

All rights reserved. Permission is granted to electronically copy and to print in hard copy for internal use only. No part of this information may be reproduced, modified, transmitted or redistributed in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, or stored in a retrieval system for any purpose other than noted above (including sales), without the prior written permission of Canada Revenue Agency, Ottawa, Ontario K1A 0L5.

© Her Majesty the Queen in Right of Canada, 2022

Tous droits réservés. Il est permis de copier sous forme électronique ou d'imprimer pour un usage interne seulement. Toutefois, il est interdit de reproduire, de modifier, de transmettre ou de redistribuer de l'information, sous quelque forme ou par quelque moyen que ce soit, de façon électronique, mécanique, photocopies ou autre, ou par stockage dans des systèmes d'extraction ou pour tout usage autre que ceux susmentionnés (incluant pour fin commerciale), sans l'autorisation écrite préalable de l'Agence du revenu du Canada, Ottawa, Ontario K1A 0L5.

© Sa Majesté la Reine du Chef du Canada, 2022

Video Tax News is a proud commercial publisher of Canada Revenue Agency's Technical Interpretations. To support you, our valued clients and your network of entrepreneurial, small businesses, we choose to offer this valuable resource to Canadian tax professionals free of charge.

For additional commentary on Technical Interpretations, court cases, government releases, and conference materials in a single practical document specifically geared toward owner-managed businesses see the Video Tax News Monthly Tax Update newsletter. This effective summary and flagging tool is the most efficient way to ensure that you, your firm, and your clients are fully supported and armed for whatever challenges are thrown your way. Packages start at $400/year.